Dr. Guendalina Anzolin (IfM, University of Cambridge), Dr. Jennifer Castañeda–Navarrete (IfM, University of Cambridge) and Dr. Dalila Ribaudo (Aston University)

In a world where perceptions shape industries and policies, understanding the narrative surrounding manufacturing is crucial. InterAct has recently published a report which analyses the perceptions of manufacturing in the United Kingdom and compares it with six other countries.

The report “How to make manufacturing charming again? It is everything, everywhere, all at once”, authored by researchers from Aston University and the University of Cambridge, examines the factors that influence these perceptions and tracks how the UK public’s perception has evolved over time.

The aim of the report is to support InterAct research on the future of manufacturing by providing insights into attitudes to manufacturing and industrial strategies, and how manufacturing is discussed in other countries, particularly where digital technologies have been adopted.

Public perceptions of manufacturing across countries and over time

Although governments remain hesitant to explicitly champion “industrial policy”, the renewed commitment to manufacturing, as evidenced in the UK’s Advanced Manufacturing Plan, underscores its pivotal role in national economies which is increasingly acknowledged by policymakers.

The multi-country review, encompassing the UK, Canada, Germany, Singapore, South Korea, Switzerland, and the US, revealed more positive perceptions of manufacturing in Germany and the US compared to the UK. However, perceptions within the UK have shown improvement. In 2001, the British public believed that the country could thrive without manufacturing. In contrast, by 2023, 93% of the public believe that the manufacturing industry is essential to economic growth and resilience.

Across countries, including the UK, a consistent trend persists; younger people exhibit the least interest in pursuing careers in manufacturing. The prevailing perception, widely held among teenagers and young adults, is that the industry is predominantly male and lacking diversity compared to other sectors. Additionally, manufacturing is perceived as being poorly paid, repetitive, and not requiring high-skilled labour. These misconceptions pose significant challenges in attracting new talent to consider the manufacturing sector as a viable and rewarding career path.

Understanding the policy and perception nexus

Industrial and innovation policies play a significant role in shaping public perceptions, which can sometimes differ from reality. Terms like “advanced manufacturing” increasingly highlight the high-tech nature of the industry. National strategies also underscore manufacturing’s role in economic growth, innovation, and regional development.

Women tend to be underrepresented in manufacturing, especially in high-tech industries. For instance, in the UK, women account for 26% of the manufacturing workforce, and their representation is even lower in high-tech sectors such as automotive and aerospace. However, gender disparities within the sector remain largely unaddressed across policies, reflecting a notable blind spot.

Megatrends reshaping manufacturing

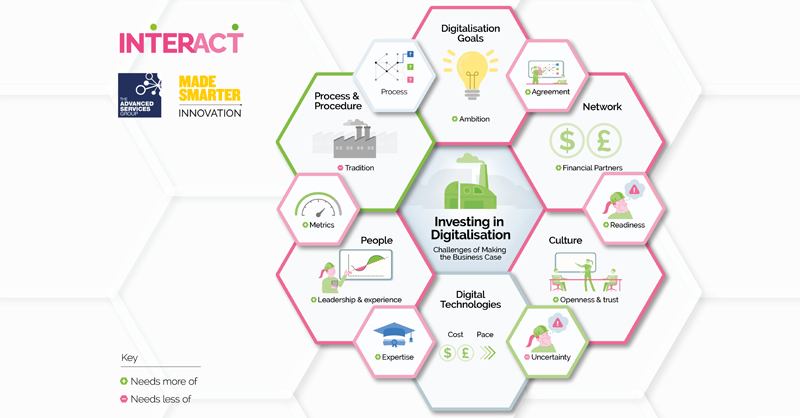

Megatrends reshaping manufacturing, such as environmental sustainability and digitalisation, persist as top priorities in industrial and innovation strategies. The interrelation of such megatrends is also becoming an area of interest in policy making. In addition, the impacts of the COVID-19 pandemic and geopolitical tensions have led to an increased emphasis on resilience, national security, value chain reconfiguration, and technological sovereignty.

These shifts in priorities and the continued focus on digitalisation and environmental sustainability have broadened the scope of activities and value chain segments within manufacturing. Notably, there is a growing emphasis on areas such as design and recycling, and the blurring boundaries between manufacturing and services.

Addressing challenges and charting a new path

This latest InterAct report highlights the evolving perception of manufacturing, emphasising the intrinsic link between policy and public perspectives. It highlights manufacturing’s multifaceted role in economic growth, innovation, and social inclusion, while also indicating pathways for improvement.

The report provides four recommendations in moving forward:

- Systematic collection of data (yearly or every 2 years) about how the public perceives manufacturing and the role of the digital and green transformations in shaping perceptions.

- Leveraging the manufacturing observatory, outlined in the UK Advanced Manufacturing Plan, to constantly monitor policy developments across different contexts. This includes how manufacturing and related terminologies are defined and portrayed.

- Setting measurable targets and initiatives aimed at enhancing diversity in manufacturing.

- Providing education and career information about manufacturing from the early stages.