Dr. Stephanie Brooks (Foods Connected)

There are terms we hear constantly in the agriculture and food sectors right now – industry 4.0, smart processes, robotic automation, Internet of Things (IoT) and Artificial Intelligence (AI) are all common buzzwords. However, while understanding the benefits of these formative ideas is relatively straightforward, putting them into practice relies on the collection, utilisation and analysis of data – data that needs to be digitally available to make this possible.

Adopting solutions that drive forward these tech advancements offers great potential in leveraging growth and productivity, but there is one sticking point. The UK agri-food industry is notoriously slow in adopting new technologies.

Of course, extraordinary events such as the Covid-19 pandemic, have accelerated the adoption of some digital technologies out of necessity, but the overall feeling has traditionally been one of reluctance, with various contributory factors including cost, resource, and general attitudes.

How to convince the sector to embrace change

There are three pillars that need to be considered to provide agri-food businesses with the confidence to adopt technology: provision, people, and practicality. These will in turn enable businesses to access the benefits that digitisation and data connectedness will bring. Let’s break them down one at a time.

Provision

It’s not that technologies haven’t been developed and tested – they have. It’s that less attention has been paid to actually provisioning tech specifically for the agri-food industry. Often technologies that make their way into the agri-food sector have been developed with a use case or other industry in mind. Only after this is the potential for it to be applied within agri-food production and/or manufacturing recognised.

Look at blockchain – its origins are in fintech, designed to trade digital currency bitcoin without the need for a trusted authority such as a bank. But repurpose this technology into the agri-food space, where it was pivoted to be an emerging technology to disincentivise and prevent fraud, and it’s clear it isn’t completely fit for purpose in its legacy form.

Why? Because the decentralised nature of blockchain means that using a typical payment model based on the number of transactions, where there are many transactions, is just not possible in a high volume/low margin sector like agri-food. So, in reality it, is just too costly to roll out. An obvious takeaway here is that if technologies are to be adapted and provisioned with the agri-food sector in mind, then it is vital that the technology providers have an in-depth knowledge of the agri-food sector.

People

It isn’t just provisioning where technology adoption currently falters. We need to shine a spotlight on how we get people to buy in. The breakdown here might not be where you think. While the benefit technology can bring to businesses is often understood on a macro level within the food industry, particularly by those in thought leadership positions, it is the onboarding of this technology’s main users that has proved more difficult.

This is not generally due to the people, but because of the change it involves. The benefits of this new way of working are not always immediately or overtly obvious to users. In fact, as a technology provider, I am often met with statements of resistance, such as: “because this is the way it has always been done”. However, this struggle to accept new technologies is often associated with a fear of change and being replaced by machines. That’s why it is so important that technology providers acknowledge these concerns and take them into consideration, reassuring users of the benefits during implementation.

Practicality

Addressing the practical aspects of a digital way of working within agri-food is the final part of making technology adoption more accessible. The responsibility here lies with the tech providers.

The processes, changes, and practical steps required to implement a new tech into a business are often confused and even misunderstood, even by the technology companies themselves.

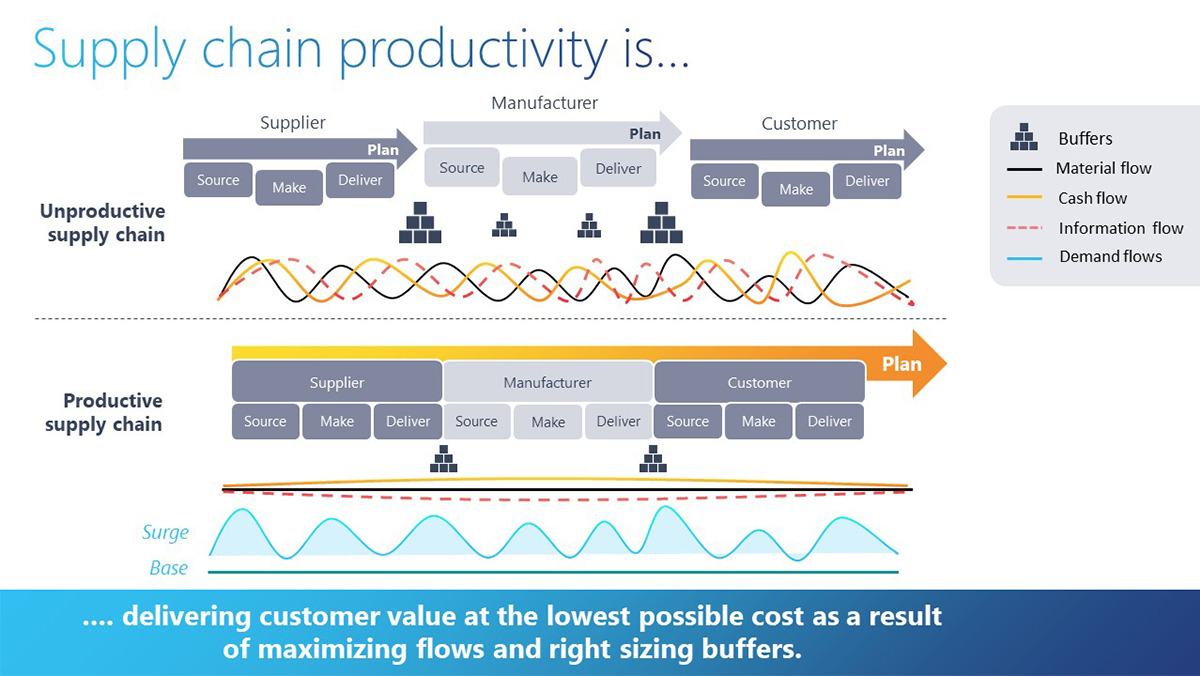

In general, the agri-food sector operates on a high-volume low-margin model, meaning that processes are tightly refined and controlled. The industry has worked hard over the last 20+ years to bring about operational efficiencies through automation, so that cost savings or profitability can be achieved.

During this period there has been less of a focus on digitising data and the value it could bring through actionable insights. When disruptive technologies enter this process, they need to do so with ease and not impact operations or processes. In addition, they need to add value rather than create costs for businesses. Furthermore, these technologies need to be able to cope with the intricacies and nuances that exist in the production and manufacturing environments. Put simply, sometimes technology will not be plug and play – especially in its infancy.

The outcome here is that the inherent benefits of digitisation are not immediately obvious, as they would be with operation efficiency gains. It is critical that technology providers take the time to understand the specific business where they are attempting to implement technologies and provide solutions that will support and enhance the business.

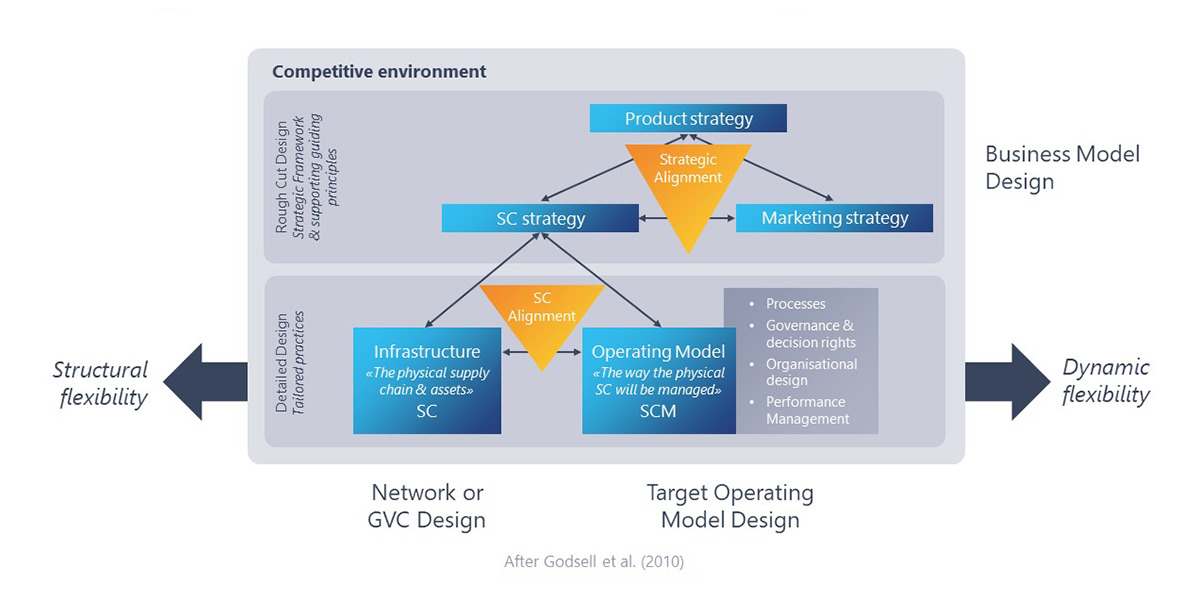

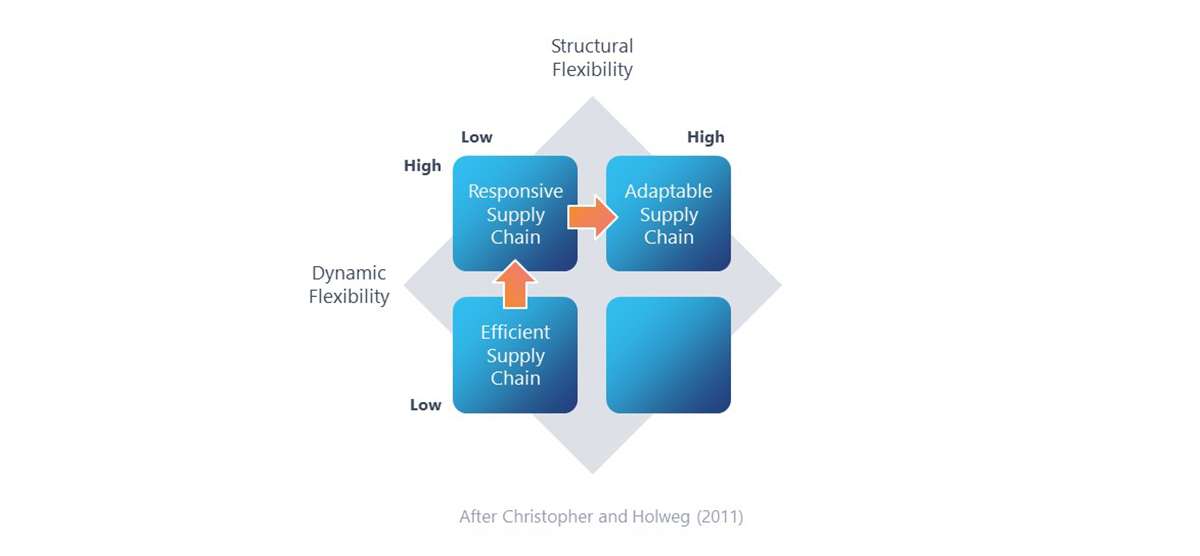

The sector, the business & the people

Ultimately, an understanding of the many aspects of the agri-food sector is critical for technology providers. Without a clear view of not just the supplier-customer relationships and their dynamics, but also the supply chain, with its global complexity and fragmented nature, and the many actors involved in the supply chain, there are sure to be issues. A grasp of all these issues assures an appreciation of the intricacies involved in technology adoption in this sector. It also ensures that technology providers can recognise any stumbling blocks ahead, while partnership with customers enables the provision of technology that is fit for purpose.

As a technology provider, Foods Connected works specifically on implementing digital solutions with Food Business Operators. The implementation of these solutions in various environments requires knowledge and understanding of how each business operates, accompanied by knowledge about the wider complexities of the sector in general. That’s why our teams have all worked in the industry and understand the intricacies of each step of the supply chain process. Our people are experts – and that’s what we need to take technology adoption forward in the agri-food industry.

After all, technology adoption and implementation are inherently coupled with people – and one cannot exist without the other.

Want to learn more about digitalisation in the agri-food industry? Watch our recorded InterAct x Foods Connected webinar: Overcoming barriers to digitalisation: adding value in the agri-food sector

About the author

Stephanie is a Senior Implementation Manager at Foods Connected. With 11 years’ experience in academia, food manufacturing and food-tech and an undergraduate degree in Food Science and a PhD in Food Supply Chain Management, Stephanie has spent her career working in food manufacturing environments in a R&D capacity, as well as working on and managing several multi million pound research projects while working for Queen’s University Belfast. Stephanie has worked with Foods Connected for the last 2.5 years, implementing, managing and delivering successful digital transformation projects within the food industry.